August 2023

IN THIS ISSUE

NFT: No Friggin’ Thanks

No, he’s not drunk

Buying the Spike

In January 2023, as ChatGPT inspired a tsunami of AI-driven investment decisions, Markets Insider published Forget ChatGPT - an AI-driven investment fund powered by IBM's Watson supercomputer is quietly beating the market by nearly 100%.

I dug in and discovered what I suspected - an atypical cherry-picked one month window of performance as the basis for optimism in the IBM Watson-powered potential for future stock picking outperformance. I promised to report back to you periodically on AIEQ’s performance because too much of our media leads us to overweight attention-grabbing headlines and short-term noise that produces systematic long term underperformance.

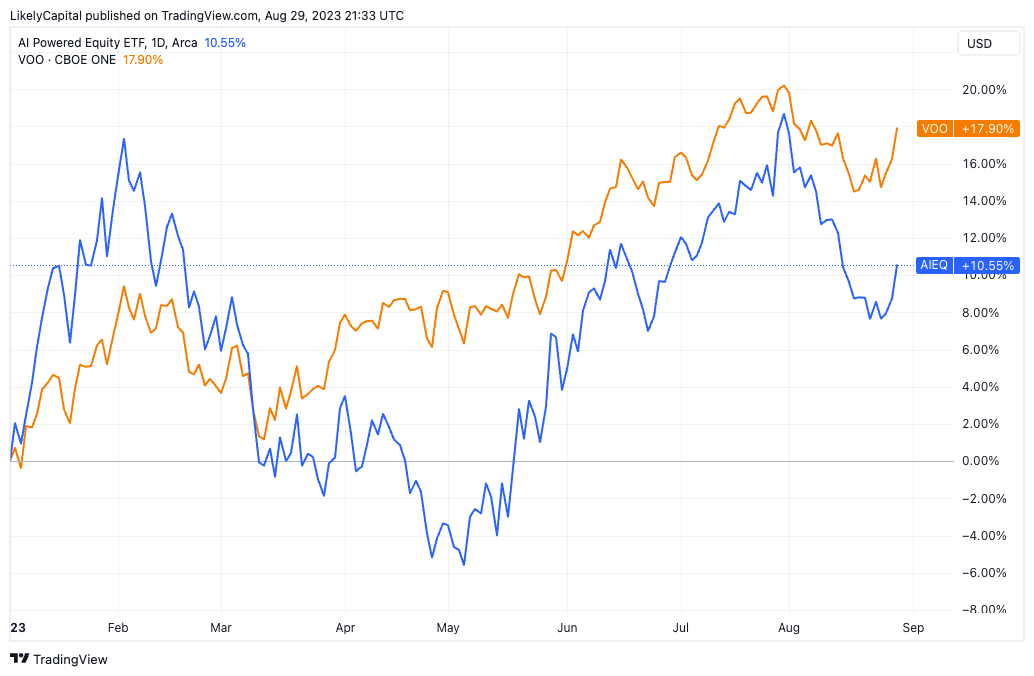

After the January 2023 spike, AIEQ retraced that full spike by early March, and since then has lagged VOO year-to-date 17.90% versus 10.55%:

What also stands out to me is the largely direction-following pattern between the two shares. Outside of March-April when AIEQ moved against VOO, all other months have seen matching directional moves between AIEQ and VOO. And further, price movements in those directions have been more extreme for AIEQ. Amplified price movements in both directions suggest a leveraged diversification effect in AIEQ’s strategy.

And considering AIEQ charges a 0.75% expense ratio versus VOO’s 0.03% expense ratio, the value-add of AIEQ’s stock picking over VOO’s diversified indexing is not clear. At all.

Now, this analysis uses time-weighted returns (more on this in a moment…) to compare performance irrespective of monetary flows into or out of these funds. AIEQ’s underperformance by 10.55 - 17.90 = -7.35% year to date does not reflect the returns that many investors tend to experience.

Why? Because investors who chase performance with an unreliable investment process usually pay for this dearly in underperformance. This year’s Artificial Intelligence chasers - at least so far - seem to be no different.

Here’s Investors Business Daily (Investors Who Bet Against Cathie Wood Pay The Price) highlighting Cathie Wood’s ARKK ETF significant outperformance in the past 6 months… and significant underperformance over the past 3 and 5 years:

It's important to note that the fund over the past three years generated a negative annualized return of 13.3%. The Nasdaq 100, in contrast, returned 14.3% annualized in the same period. And the past five years aren't much better. ARK Innovation returned just 2.1% annualized in the past five years, trailing the QQQ's 16.9% annualized return in that period by a wide margin.

And here’s a Wall Street Journal piece Investors Are Bailing on Cathie Wood’s Popular ARK Fund - just one day before the Investors Business Daily article(!) - putting ARKK’s performance in dollar-weighted terms to reveal the returns that many ARKK shareholders are experiencing:

The ARKK fund has an 11% annualized average return since inception, but the average ARKK investor has lost 21% on a dollar-weighted, annualized basis, according to FactSet.

“ARKK shareholders have not timed their purchases well. Many bought high and have yet to sell,” said Elisabeth Kashner, director of global funds research at FactSet.

Hence the title of this segment - “Buying the Spike” is a reeeeaaaaally rough way to invest.

ONE MORE THING…

NFT: No Friggin’ Thanks. Especially not Jack Dorsey’s first tweet. An NFT of Jack Dorsey's first tweet bought for $2.9M is now valued at less than $4

No, he’s not drunk. This works better than many active strategies. Beer billionaire Jim Koch buys a random stock every 2 weeks - and trusts his former babysitter to execute his trades

The information and opinions contained in this newsletter are for background and informational/educational purposes only. The information herein is not personalized investment advice nor an investment recommendation on the part of Likely Capital Management, LLC (“Likely Capital”). No portion of the commentary included herein is to be construed as an offer or a solicitation to effect any transaction in securities. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained herein, and no liability is accepted as to the accuracy or completeness of any such information or opinions.

Past performance is not indicative of future performance. There can be no assurance that any investment described herein will replicate its past performance or achieve its current objectives.

Copyright in this newsletter is owned by Likely Capital unless otherwise indicated. The unauthorized use of any material herein may violate numerous statutes, regulations and laws, including, but not limited to, copyright or trademark laws.

Any third-party web sites (“Linked Sites”) or services linked to by this newsletter are not under our control, and therefore we take no responsibility for the Linked Site’s content. The inclusion of any Linked Site does not imply endorsement by Likely Capital of the Linked Site. Use of any such Linked Site is at the user’s own risk.