December 2024

IN THIS ISSUE

Elon or Warren?

Pseudo-passive indexing

Yes, valuations are high

Fartcoins. Seriously.

Which party is better for stocks?

As Washington transitions from Democratic to Republican leadership, folks are asking: Are Democrats or Republicans better for stocks?

I find little value in contemplating this question:

For one, inherent in the question are countless complexities that virtually nobody answering this question seems to care about.

For two, peoples’ answers often look at simple returns during each President’s term with insufficient consideration to the inherited circumstances or pertinent dynamics that constrain each President’s policy-making against which they will be judged.

For three, peoples’ answers are almost always skewed by political ideology rather than objective analysis.

For four, Presidents don’t have any meaningful control over stock markets worthy of the responsibility we give them over those markets.

For five, it is not clear that there is predictive investing value in whatever answer at which one arrives. As it relates to the present, Donald Trump is quite clearly a non-representative Republican relative to prior Republican Presidents, so who’s to say that market returns under prior Republican Presidents can provide predictive value for future returns under Donald Trump’s next 4 years?

Of course none of this stops people from spewing answers.

For those who are satisfied by considering general stock market returns filtered by political party of the sitting President, the S&P 500 performance has been pretty good regardless of who is sitting behind the Resolute Desk. Stocks go up with both Democratic and Republican Presidents:

Digging into the numbers, if you are a Democrat, you might note that since 1957 the S&P 500 had a 12.9% median annual return under Democratic Presidents but only a 9.9% median annual return under Republican Presidents. But if you are a Republican, you might counter that since 1957 the S&P 500 had a 10.2% Compound Annual Growth Rate (CAGR) under Republican Presidents but only a 9.4% CAGR under Democratic Presidents.

Sheesh! Put political metric-picking aside already. If all you care about is simple market returns, stocks do well under both Republican and Democratic Presidents. Presidents are not dictators, they do not control either the stock market or the economy in general, and, as Freakonomics notes, the President does not matter as much as you think.

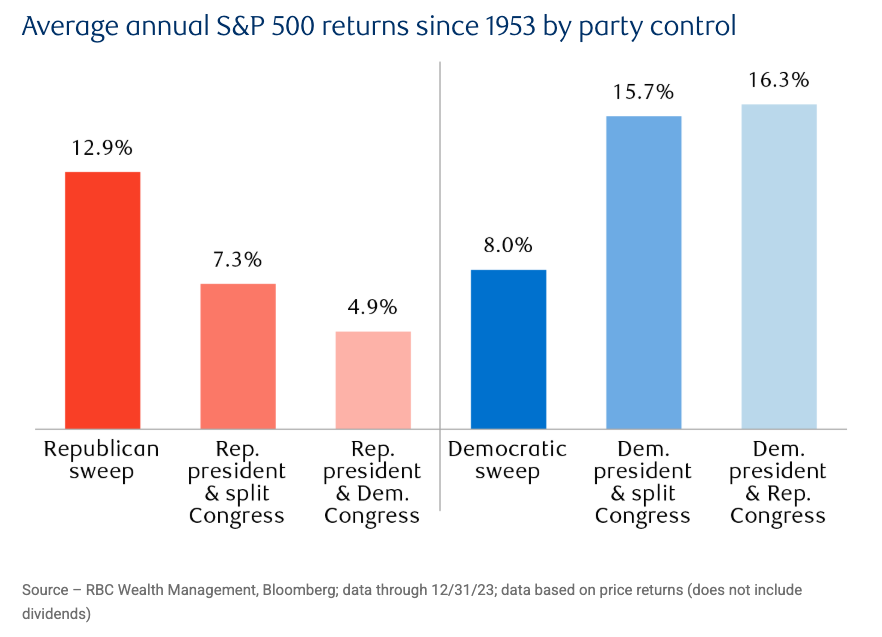

Now, if you care even just a little bit about circumstances, such as the Congress with which a President must work, S&P 500 returns are strongest when there are Democratic Presidents with either split or Republican Congresses:

But why? Yeah, I don’t know either.

Finally, many sophisticated investors and managers care about so-called “risk-adjusted” returns, by which one adjusts actual returns by the prevailing “risk-free rate” or some similar “guaranteed” investment (e.g. U.S. Treasurys). If you are interested in a statistically risk-adjusted approach, think about this question through the lens of risk averse voters versus risk seeking voters.

When investors are risk averse, they tend to prefer safer investments with lower returns. So what if investors also tend to be risk averse when certain political parties are in the White House?

Indeed there is an interesting finding when framing the “Which party is better for stocks?” question in terms of risk aversion. Consider this respectable approach courtesy of Ben Felix in Trump’s Win and Expected Stock Returns (The Presidential Puzzle):

The empirical fact here is striking. The vast majority of historical US equity risk premium has been delivered under Democratic Presidents. This is based on a November 2020 paper in the Journal of Political Economy looking at data up to 2015. The headline empirical result discussed in the paper is that from 1927 to 2015 the average market return in excess of 3-month Treasury Bills under Democratic Presidents is 10.7% per year, while under Republican Presidents it is -0.2% per year.

…

This empirical puzzle was first identified in a 2003 paper in the Journal of Finance, The Presidential Puzzle: Political Cycles and the Stock Market, and found to persist out of sample in the 2020 paper Political Cycles and Stock Returns.

The tempting explanation for the Puzzle is the different economic policies that the two parties represent. But that’s not really how markets work. The expected effects of economic policies are quickly reflected in stock prices. That explanation would imply that investors persistently misprice stocks by failing to anticipate the expected policy effects.

There is a simpler explanation offered by the authors of Political Cycles and Stock Returns. Democrats tend to get elected when expected future stock returns are higher, and Republicans tend to get elected when they are lower. This could happen because investors’ aversion varies over time, depending on what’s happening around them. For example, risk aversion is likely to be high during economic crises. When risk aversion is high, investors demand more compensation for taking risks, which on average plays out as higher realized stock returns. How this relates back to politics is that when risk aversion is high, like during economic crises, voters are more likely to elect Democratic Presidents because they demand more social insurance, while when risk aversion is low, like during a booming economy and stock market, voters are more likely to elect a Republican Presidents because they want to take more business risk.

The result is that when Democrats get elected, risk aversion tends to be higher, leading to higher expected stock returns. And when Republicans are elected, risk aversion tends to be lower, leading to lower expected stock returns. Importantly, in this model, Democratic Presidents do not cause high expected stock returns. Higher risk aversion causes both Democratic Presidents to get elected and expected stock returns to be high at around the same time. It’s a similar story in the other direction for Republican Presidents. They do not cause stock returns to be low, but low risk aversion tends to result in Republican Presidents getting elected and expected stock returns being low.

Risk aversion should be at the forefront of every responsible manager’s investment process. And of those who care about answering which political party is better for stocks.

ONE MORE THING…

Elon or Warren? Elon says Warren’s approach is “pretty boring”. Warren says “it’s amazing how hard people make what a simple game this is.” Well, as I would adapt Ellenberg’s quote, “if investing is exciting, you’re doing it wrong.”

Pseudo-passive indexing. If you are actively managing a “supercharged index fund”, you are not really indexing. Billionaires Are Buying a Supercharged Index Fund That Includes Nvidia, Tesla, and Other "Magnificent Seven" Stocks | The Motley Fool

Yes, valuations are high. These Are the Wildest, Weirdest Stock-Market Prices We’ve Ever Seen - WSJ

Fartcoins. Seriously. Don’t invest this way. Memecoins like Fartcoin are riding Trump's victory to huge valuations. Experts say it may have only begun.

The information and opinions contained in this newsletter are for background and informational/educational purposes only. The information herein is not personalized investment advice nor an investment recommendation on the part of Likely Capital Management, LLC (“Likely Capital”). No portion of the commentary included herein is to be construed as an offer or a solicitation to effect any transaction in securities. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained herein, and no liability is accepted as to the accuracy or completeness of any such information or opinions.

Past performance is not indicative of future performance. There can be no assurance that any investment described herein will replicate its past performance or achieve its current objectives.

Copyright in this newsletter is owned by Likely Capital unless otherwise indicated. The unauthorized use of any material herein may violate numerous statutes, regulations and laws, including, but not limited to, copyright or trademark laws.

Any third-party web sites (“Linked Sites”) or services linked to by this newsletter are not under our control, and therefore we take no responsibility for the Linked Site’s content. The inclusion of any Linked Site does not imply endorsement by Likely Capital of the Linked Site. Use of any such Linked Site is at the user’s own risk.