JULY 2022

IN THIS ISSUE

A better inflation hedge.

I never play the lottery. But if I did…

“Serious Possibility Capital Management”

Disconnects

Sometimes markets seem to not make sense.

Opportunities necessarily exist in the future. Forward-looking investors buy shares before the release of expected good news. Once that good news is released they sell to take profits, the selling of which causes the share price to drop. This dynamic looks backwards to outside observers - why did good news cause the share price to go down? But looking under the hood, some basic research can explain this sensible dynamic, widely known as “buy the rumor, sell the news”.

Sometimes though, the contradictory data points are so disconnected and very difficult to explain.

How can both GDP and unemployment simultaneously drop? GDP is a broad measure of what an economy produces, and employment does the work of that production. The negative correlation makes sense conceptually and is supported by historical data:

Okun’s Law predicts that a 1% increase in employment will be associated with a 2% increase in GDP. The inverse also applies, a 1% decrease in employment will be associated with a 2% increase in GDP.

Thinking in Likelyhoods, there are a number of statistical nuances. Association does not imply causation, and complex economic interactions often create lags in statistical effects, to name just two. The Federal Reserve Bank of St. Louis also narrowed the scope of the law to the natural rate of unemployment:

"[Okun's Law] is intended to tell us how much of a country’s gross domestic product (GDP) may be lost when the unemployment rate is above its natural rate." (Okun’s Law: A Meaningful Guide for Monetary Policy? - Economic Synopses - St. Louis Fed)

Suffice it to say, the economic dynamics are complex. But that has not stopped economists and market participants from noticing and questioning the sustainability of the current dynamic of unemployment falling against the backdrop of falling GDP:

Payrolls increased 372,000 in June, more than expected, as jobs market defies recession fears (CNBC)

There are implications for the bond markets also: Bonds aren't doing what they normally would in a bear market and they're becoming more attractive than stocks right now, one strategist says

With all the attention around an impending inflation-induced recession, inevitably the causes of inflation include consumer expectations. If consumers expect prices to increase, one way they may respond is by tolerating those price increases and not actually changing their buying behaviors, like downshifting or other inflation-suppressing actions. Here’s Paul Krugman pointing out this “immense disconnect”:

Source: Twitter

Last August I wrote:

“Managers trying to use pre-pandemic models to gain predictive insights about market returns during an unprecedented, once-in-a-lifetime pandemic are bound to be misled. The times when models are most predictive are usually when models are not needed, and accordingly the times when models are least predictive are usually when models are most demanded.”

To the extent that the current inflationary recession lacks comparable historical precedents, predictive models may not be very predictive. Perceived or real disconnects in complex economic metrics call for a reliable process, prudent decision making, and commitment to a proven long term strategy. Investing is a no-called strikes game - particularly when market disconnects do not make sense, it is perfectly appropriate to decline to take a position and wait for the next pitch.

Inverse Cramer Strategy

How are you doing in life if you have an inverse strategy named after you?

If you have sufficient stature, name recognition, followers, media footprint, etc. that people are interested in your stock picks, you presumably are doing very well. If a rigorous analysis shows that reversing your picks would outperform the market? Well, you probably wish that analysis did not exist.

We have all been there - we are on the wrong sides of our trades and wonder “If only I did the opposite, I would be golden”. So naturally, the folks at QuiverQuant have created an “Inverse Cramer Strategy” to take the other side of Jim Cramer’s stock picks. Perhaps surprisingly - but come on, you knew where I have been building to - their analysis shows that Jim Cramer’s stock picks underperform the market within the one month after he makes his stock picks and that taking the other side of his picks indeed would achieve the elusive outperformance of the broader market.

There are other considerations and nuances that careful thinkers should consider.

QuiverQuant uses a short 1 month window - presumably to try to isolate the causes of price movements to just his picks - but Cramer is not making picks with a 1 month duration in mind.

Backtesting is dangerous. Market trends and cycles can last longer than backtested periods, so what works in one time period will not necessarily continue to work in future periods. Quiver Quantitative’s analysis covered the past 2 years of recommendations, which is much too short for my liking.

As I have written before, sometimes the attention gained from surprising stock picks, divergent thinking, and going against the grain is worth more than the long-term underperformance record of those picks when few people track that performance to know their quality. Well, Quiver Quantitative is changing that.

From Quiver Quantitative: “purely doing the opposite of everything that Jim Cramer recommends would not deliver the best results, as both his short and his long picks seem to have consistently underperformed the market.”

Stock picking is a losing game, and while Cramer’s underperformance does stand out from other CNBC commentators’ picks (on Halftime Report, Fast Money, and Mad Money), his underperformance is not unusual:

“Across all picks made on the network since 2021, buy recommendations have underperformed the market by 1.04% on average, while sell recommendations have underperformed by 1.99%. Based on this, it seems as though the commentators at CNBC are significantly better at picking losers than they are at picking winners.”

Crypto crash-o

With crypto crashing, Celsius filing for bankruptcy protections, Voyager filing for bankruptcy, Judge freezing assets of Three Arrows Capital, it is worth remembering that not all volatility is created equal and volatility does not equal risk.

See also:

They gather on Telegram to let out howls of grief and short, sharp shrieks of pain. “Eeeeeeee!” yowls a young woman. “Waahahahah,” roars a man in a deep baritone. A third person wails like a baby. These are victims of the cryptocurrency bloodbath, 3,315 of whom have assembled in a “Bear Market Screaming Therapy Group” group to vent their anguish. “I had a few people lamenting and crying,” says the group’s founder, a 30-year-old cryptocurrency investor who gives only his first name, Giulio. “I decided not to ban them. I felt bad. They weren’t even able to scream any more. They were just sobbing.”

Bloomberg reported earlier this week that Mr. Scaramucci’s firm SkyBridge Capital had halted withdrawals from one of its smaller funds, Legion Strategies, which contains just over $200 million. But Mr. Scaramucci is also struggling to hold on to investors in SkyBridge’s flagship fund, the SkyBridge Multi-Adviser Hedge Fund Portfolios, which managed as much as $2 billion at the end of March. Its investments lost nearly a quarter of their value in the second quarter.

Investors in SkyBridge’s flagship fund are seeking to withdraw as much as $890 million, or about half of the money that it held as of the end of last month, Mr. Scaramucci told the DealBook newsletter. But many of those investors will be stuck in the fund for a while.

…

Earlier this month, SkyBridge told its clients in a letter that its redemption window had been “oversubscribed” and that they would collectively receive only about 16 percent of the money they requested. The letter said it was issuing investors’ notes for that amount that would be paid no later than October.

Mr. Scaramucci’s losses come just over a year after SkyBridge’s pivot into crypto.

ONE MORE THING…

A better inflation hedge. Corporate profits are rising faster than inflation-inducing wages. There are other sources of inflation besides wages, but hey, so far stocks seem to be acting like a better hedge than Bitcoin. Debunking 4 Myths About Inflation | Robert Reich

I never play the lottery. But if I did… I would absolutely move to one of these 10 best states where lottery payouts have the most favorable tax treatment. The 10 best places to win the $1.34 billion Mega Millions jackpot

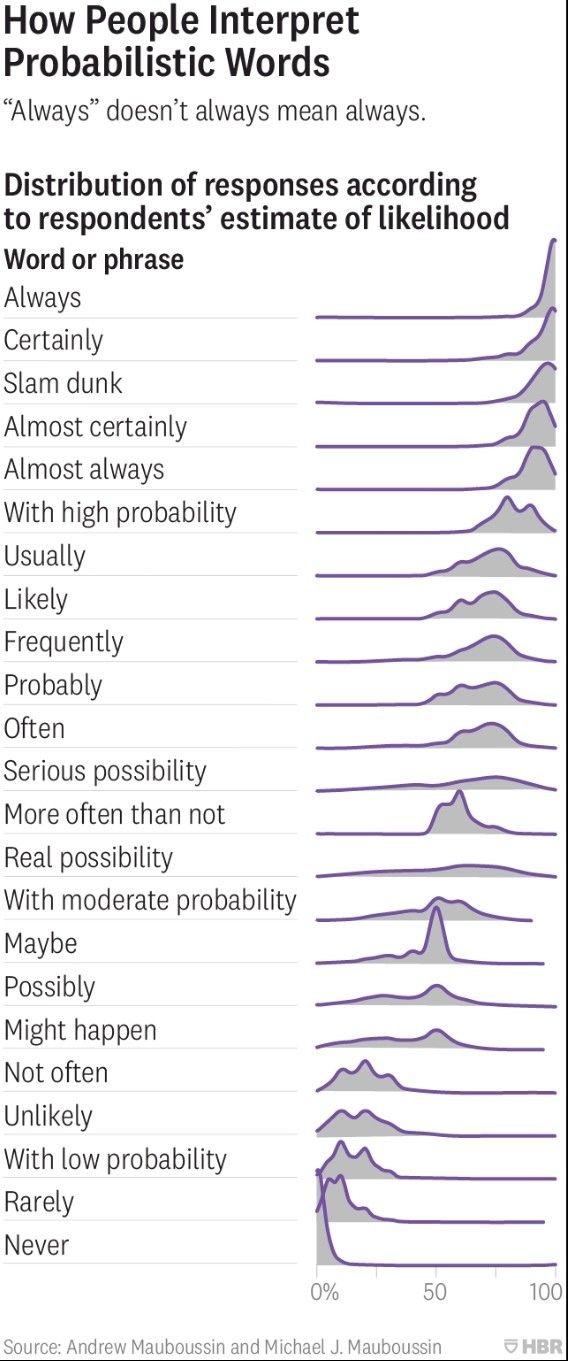

“Serious Possibility Capital Management” just doesn’t have the same ring as Likely Capital Management. Here’s how people interpret probabilistic words, from Team Mauboussin:

The information and opinions contained in this newsletter are for background and informational/educational purposes only. The information herein is not personalized investment advice nor an investment recommendation on the part of Likely Capital Management, LLC (“Likely Capital”). No portion of the commentary included herein is to be construed as an offer or a solicitation to effect any transaction in securities. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained herein, and no liability is accepted as to the accuracy or completeness of any such information or opinions.

Past performance is not indicative of future performance. There can be no assurance that any investment described herein will replicate its past performance or achieve its current objectives.

Copyright in this newsletter is owned by Likely Capital unless otherwise indicated. The unauthorized use of any material herein may violate numerous statutes, regulations and laws, including, but not limited to, copyright or trademark laws.

Any third-party web sites (“Linked Sites”) or services linked to by this newsletter are not under our control, and therefore we take no responsibility for the Linked Site’s content. The inclusion of any Linked Site does not imply endorsement by Likely Capital of the Linked Site. Use of any such Linked Site is at the user’s own risk.