December 2021

Insider selling is surging

Football Referee: “Offsides, on the Hedge Funds, 5 yard penalty…”

When “Buy the Dip” no longer works

Buy the Dip, or Buy the Crash?

It’s about performance

“Cashin the Contrarian”

Where are they now?

Oversimplifying here, but the way most people consume media is like this:

We are deluged by content competing for short attention spans

We forget most of what we consume

Rinse and repeat

Pop quiz: Write down all the headlines you recall from last week.

See?

The problem is that we lack a connective framework for making sense of the new content. A helpful life hack I use is to purposefully identify each day’s most important content, typically 0-1 pieces but sometimes more, then save those URLs or ideas into a rolling calendar reminder. Each day when the reminder pops up, I reread saved content from 2 days before. By re-consuming each day’s most important content a few days later, I reactivate and strengthen the learning from my first encounter with that content.

For me, reading half as much content twice promotes better and more permanent learning than reading twice as much content once.

Anyway, a strategically helpful thing to do after reading an interesting prediction - market commentators make loads of predictions of course - is to again save that article in a calendar reminder for several months later, after which there will be clarity on the accuracy of the prediction.

Not surprisingly, many predictions turn out to be either false or greatly exaggerated. This effect is of little surprise, since mundane predictions are rarely newsworthy and likewise not good click-bait. In October I wrote about Jack Dorsey’s “hyperinflation” prediction that got loads of attention and is very Likely to be false.

But there are plenty of times when valuable lessons can be learned from revisiting old news. In August I wrote both about how short attention spans deprive us of learning from old news…

The race to fill the top of users’ timelines are, arguably, a consequence of our increasingly short attention spans. As attentions flip to the next short-lived headline, we too easily neglect to remember and learn from the outcomes of prior newsworthy events.

…and how Soros Fund Management snatched up (seemingly) fire-sale shares in VIAC, DISCA, and BIDU following the Archegos collapse. From Bloomberg back in May, Soros Bought Up Stocks Linked to Bill Hwang’s Archegos Implosion:

Billionaire George Soros’s investment firm snapped up shares of ViacomCBS, Discovery and Baidu as they were being sold off in massive blocks during the collapse of Bill Hwang’s Archegos Capital Management.

Soros Fund Management bought $194 million of ViacomCBS Inc., Baidu Inc. stock valued at $77 million, as well $46 million of Vipshop Holdings Ltd. and $34 million of Tencent Music Entertainment Group during the first quarter, according to a regulatory filing released Friday. A person familiar with the fund’s trading said the company didn’t hold the shares prior to Archegos’s implosion.

…

“When there’s a dislocation, we’re prepared to not just double down but triple down when the facts and circumstances support that,” [CIO Dawn Fitzpatrick], 51, said in a “Front Row” interview on Bloomberg TV.

...

The 13F filing provides one of the first examples of how a hedge fund attempted to capitalize on the distressed remains of Archegos. It also offers an insight into Soros’s investment firm, which is run by Chief Investment Officer Dawn Fitzpatrick.

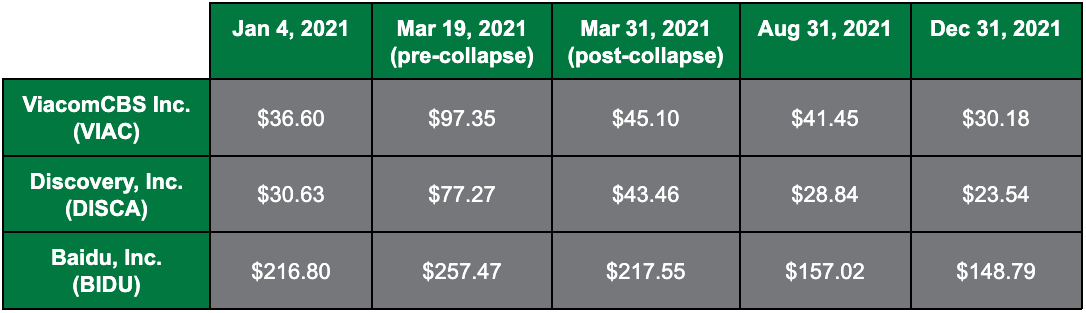

In what I dubbed “Sore-os”, those shares continued their decline 5 months through August post-Archegos. And now for another update, from August 31st through Dec 31st, all three companies, VIAC, DISCA, and BIDU continued their retreats since March 31st, with 27.2%, 45.8%, and 31.6% declines respectively:

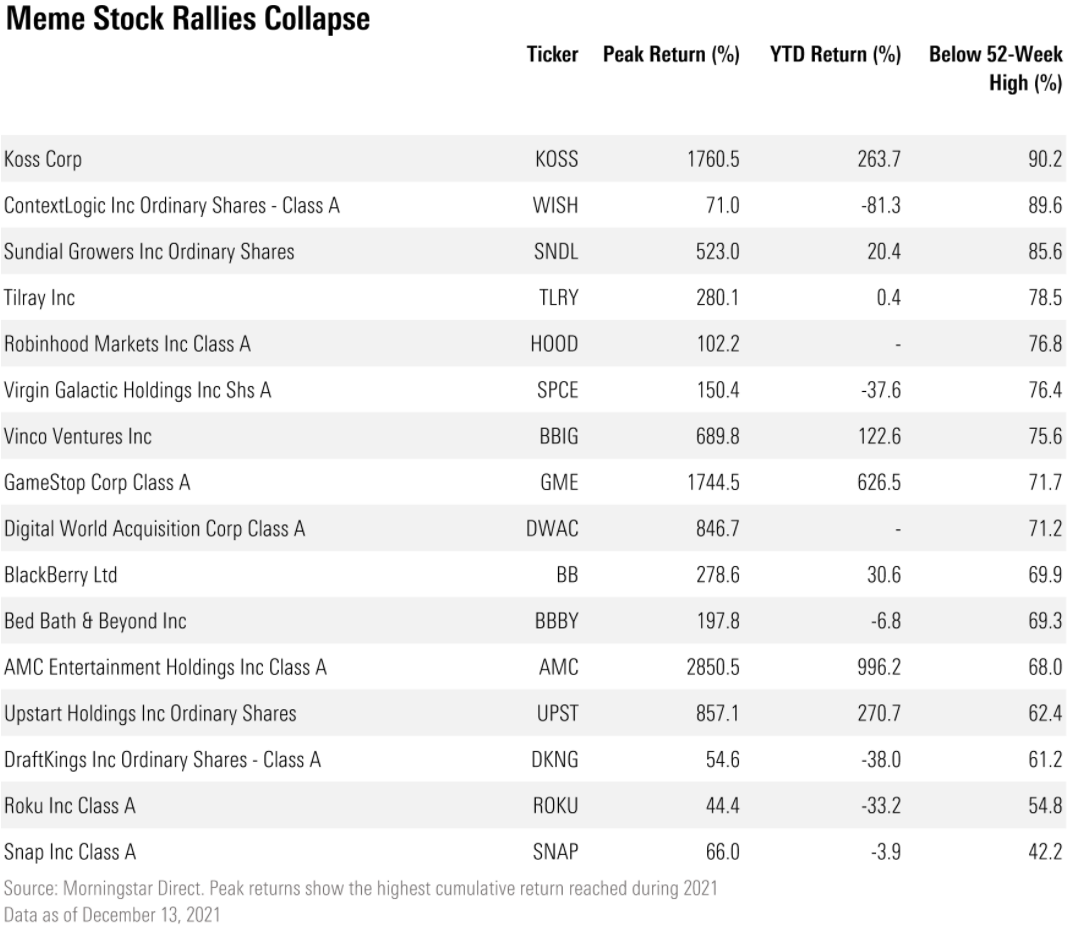

Aptly, Morningstar asked this segment’s title question “Where Are They Now?” in the context of the Meme Stock Mania of 2021: Meme Stocks: Where Are They Now? Here is their table quantifying the mostly positive YTD returns but all significantly below their 52-week highs.

In the absence of a reliable process, investors are Likely to find themselves in the right-hand column, buying in at or near the all-time highs when the media coverage is ubiquitous but left holding the bag as prices drift back down to Earth. Behavioral biases abound in this environment, including:

Resulting (judging quality of decisions by their outcome not process)

Recency Bias (overweighting recent information relative to their objective long-term probabilities)

Overconfidence (unsubstantiated confidence relative to market uncertainty)

Fundamental Attribution Error (overemphasizing personal qualities in explaining positive results while underemphasizing situational explanations)

Herd Mentality (following others under the assumption that the herd has already done the research that one ordinarily would do themselves)

Illusion of Control (belief that we have more control over less-controllable events)

A reliable investment process is essential to managing risk and avoiding these preventable outcomes.

Let’s just say that for these late-to-the-party investors, meme stock returns were, ahem, “transitory”.

Of course every manager makes losing trades, that is not the point. What matters is that every manager employs a process to analyze a large number of their previous decisions - another reason why a long track record is essential - that then serves as the basis for informed refinements to their decision-making processes. A reliable process supports managers in informed decision-making and avoiding chasing performance.

Every investor wants to outperform, and alpha is one measure of that outperformance relative to some benchmark. Russell Fuller, President of Fuller & Thaler (yes, that Thaler, the Nobel Prize winning behavioral economist), wrote this classic paper in 2000 titled Behavioral Finance and the Sources of Alpha . Those three sources are:

Superior (Private) Information

Process Information Better

Behavioral Biases

Given the gusher of widely available information behind what I call the “Mostly Efficient Markets Hypothesis”, it is difficult for managers to add value through superior information. But asking the question “Where are they now?”, having a process both for (re)learning from the most important recent news (#2 Processing Information Better) and a reflective self-awareness of one’s performance-reducing psychologies (#3 Behavioral Biases) go a long way as sources of outperformance.

The use of “transitory” was, well, “transitory”

The quote of the month goes to Jay Powell, Chair of the Federal Reserve:

"I think the word transitory has different meanings to different people. To many, it carries a sense of short lived. We tend to use it to mean that it won’t leave a permanent mark in the form of higher inflation. I think it’s probably a good time to retire that word and try to explain more clearly what we mean."

For all the debate among commentators over whether inflation is transitory or structural… although the debate is interesting, the debate also misses the mark.

…

The issue is not actually about transitory inflation versus structural inflation, but rather about the duration of inflation and whether consumers can tolerate those inflationary pressures throughout that duration.

Until further notice, I am with the guy who holds inflation’s policy toolbelt.

There are some who will read Powell’s statement to “retire that word” as debate-settling vindication. I leave this narrative nonsense to the pundits.

For investors with skin in the game, one of the most important dynamics to monitor early this year is whether inflation metrics respond to the imminent interest rate cuts. If interest rate increases do not effectively suppress inflation, then that dynamic would provide evidence for the structural inflation camp (and an impotent Federal Reserve). But if the Fed’s interest rate policy effectively tempers and reduces inflation, then that would provide evidence for the transitory inflation case - as the Fed has argued all along.

Watch this space.

ONE MORE THING…

Insider selling is surging. If insiders think it’s a good time to sell, then… CEOs and insiders sell a record $69 billion of their stock, and the year isn't over yet

Football Referee: “Offsides, on the Hedge Funds, 5 yard penalty…” Hedge Funds Caught Massively Offside During Last Week's Turmoil

When “Buy the Dip” no longer works. Traders Sent $30 Billion Into the Dip and This Time Got Bruised - Bloomberg

Buy the Dip, or Buy the Crash? How to tell if a stock market dip is turning into a crash

It’s about performance. Meet the Kidd Who Goes Toe to Toe With Warren Buffett

“Cashin the Contrarian”. Art Cashin sees inflation peaking soon and other surprises for the market in 2022

The information and opinions contained in this newsletter are for background and informational/educational purposes only. The information herein is not personalized investment advice nor an investment recommendation on the part of Likely Capital Management, LLC (“Likely Capital”). No portion of the commentary included herein is to be construed as an offer or a solicitation to effect any transaction in securities. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained herein, and no liability is accepted as to the accuracy or completeness of any such information or opinions.

Past performance is not indicative of future performance. There can be no assurance that any investment described herein will replicate its past performance or achieve its current objectives.

Copyright in this newsletter is owned by Likely Capital unless otherwise indicated. The unauthorized use of any material herein may violate numerous statutes, regulations and laws, including, but not limited to, copyright or trademark laws.

Any third-party web sites (“Linked Sites”) or services linked to by this newsletter are not under our control, and therefore we take no responsibility for the Linked Site’s content. The inclusion of any Linked Site does not imply endorsement by Likely Capital of the Linked Site. Use of any such Linked Site is at the user’s own risk.